Crow your money securely while maximising your business returns

Grow your wealth securely while maximising your business returns.

Multitude of features and benefits, designed to provide the greatest level of transaction flexibility.

Discover

Designed for business with high cash desposits with flexibility to suit the different customer needs.

Discover

Transact in multiple foreign currencies including overseas transfer/payment and convert the balance into Malaysian Ringgit whenever.

DiscoverFinance your business growth and take your business to the next level.

Improve business stability and streamline your operations anywhere and anytime.

Conduct business with confidence with comprehensive protection that has always got your back.

24 Hours Module Coverage

Cover from 10 to 150 employees

Cashless Reimbursement Option

A shariah compliant Takaful plan protecting customers' business financing in the event of detah or Total Permanent Disablement (TPD)

Pay your outstanding business loan based on reducing sum insured in the event of death or disability.

Covers outstanding business loan with a guaranteed sum assured in the event of death or disability.

Takes care of the outstanding balance of your mortgage in the

case of any unfortunate event.

Provide Takaful protection with

level sum covered throughout

the certificate years.

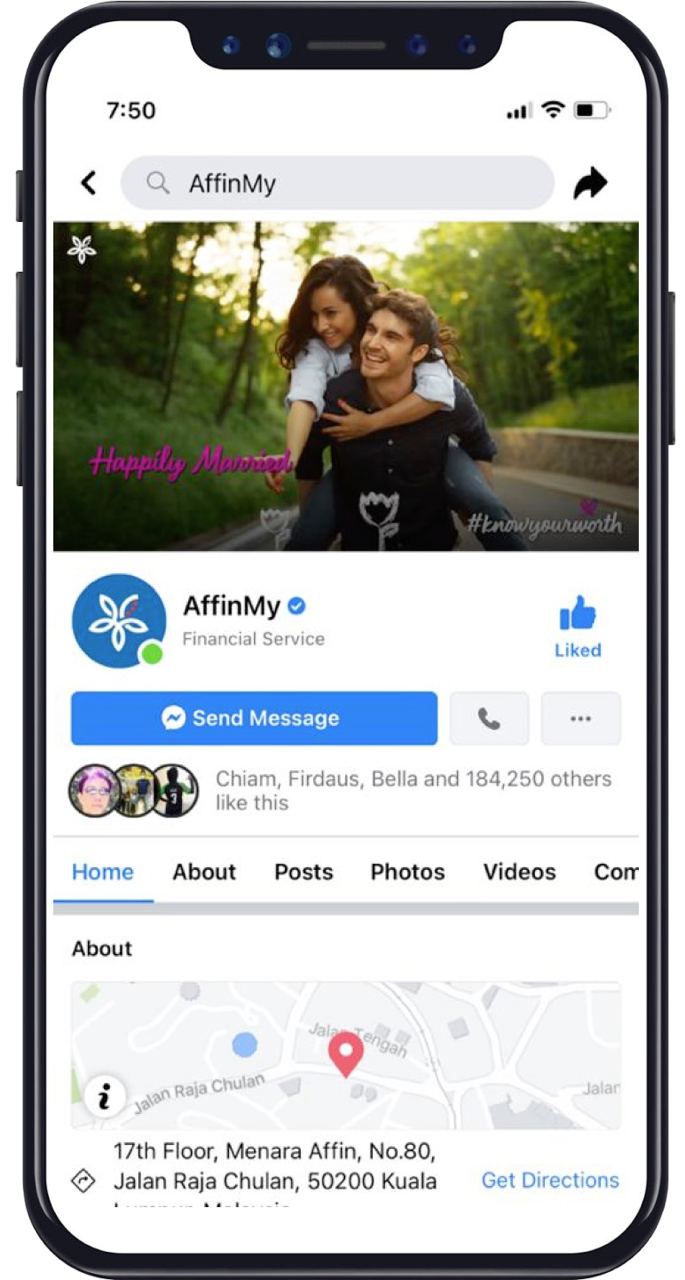

There are more ways to reach us